A noncitizen who married an American residing abroad, and who meets the conventional criteria for spousal or survivor Rewards, might be suitable for these payments if he or she:

two. If I fax the form on 10th of January 2021 and after a 7 days I simply call and ask for a duplicate of my EIN Verification Letter (147C) within the IRS for my LLC will they offer it to me( Otherwise one particular 7 days, just how long must I wait)

Sign in or create an account to post your ask for You are able to swap your card online and acquire it in fourteen days. You may as well use your account to examine the status within your request and manage other Advantages you receive from us.

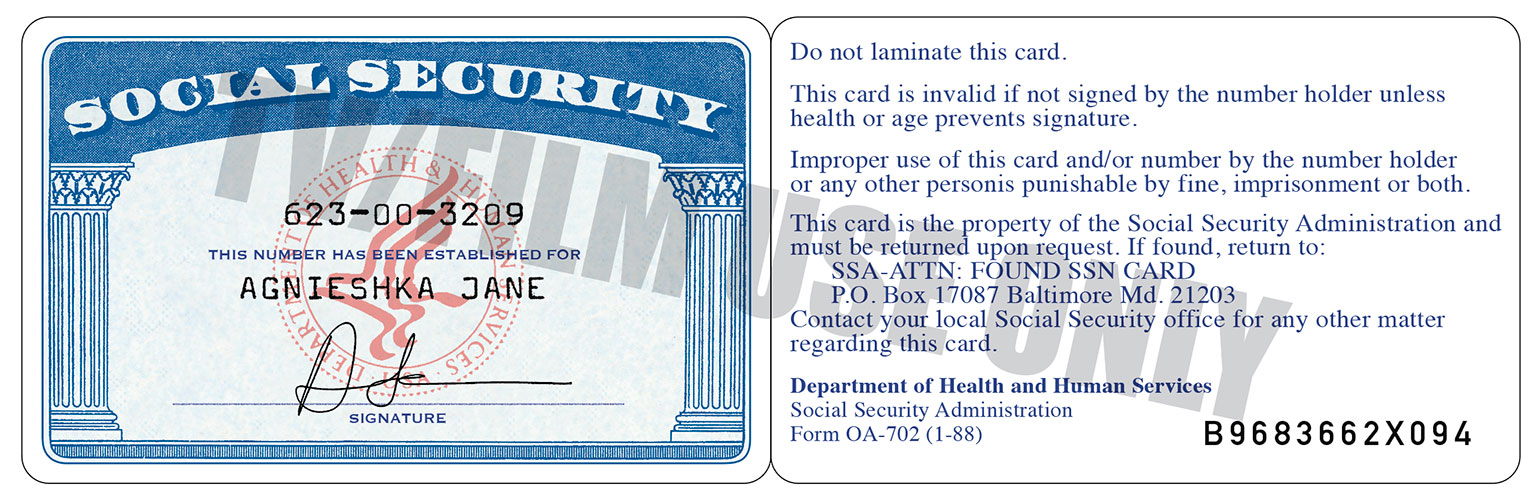

Considering the fact that 1972, the SSA has issued Social Security cards centrally and the realm number reflected the state, as based on the ZIP code within the mailing deal with of the appliance.

The IRS issues EINs to foreigners on a regular basis and this is what you have to enter in case you don’t have an SSN or ITIN.

What a wonderful Web page you had designed. My congratulations to you and your crew, if any, and many thanks for sharing all this know-how.

You will pay U.S. taxes based upon what state you will be from, what tax treaty is set up, how and where by your LLC can make funds, where by your clientele are, In case your full documents website LLC provides a “everlasting institution” within the U.

Wherever anyone provides a demonstrable spiritual objection to a number (including selected Christians being averse for the number 666).

three- is there a chance I could get a copy or find my SSN with social-security-card-online-ssn the authorities, without having to drop by United states of america?

I just filled out the SS-4 and I've just one very simple concern, ultimately of the shape, the signature and day fields, they're not editable fields the place I am able to style them on the computer, so do you signify print out the form right after filling it out then write the signature along with the day fields by hand? please suggest

Yesterday i had faxed the SS4 type and certificate of formation to IRS. Only to note i sent the certificate that's not still been stamped with the point out.

Make certain your LLC is authorised to start with just before applying in your EIN to prevent possessing an EIN attached to the incorrect LLC title (When your LLC filing receives rejected).

Failing to inform the Social Security Administration of a name alter may have repercussions. If your legal name isn't going to match the name in your Social Security file, it could prevent the agency from crediting earnings to you or result in delays in processing your tax return.

just A fast query , I'm a canadian citizen , who may have opened LLC by way of registered agent in US and thats the only tackle We've and now i am applying for more information about social-security-card-online-ssn SS-four EIN , Hence the query is wherever need to i be mailing the paperwork to ?

Comments on “The Fact About social-security-card-online-ssn That No One Is Suggesting”